Stocktaking

Daniel Keller, Lazy Ocean Drift (Deutsche Neuaufname), 2014, Audio (4min20sec), Soca Can Speaker, Novelty Flash Drive, USB cables, Power Supply, 4.33 x 2.33 inches [courtesy of the artist and Kraupa-Tuskany Zeidler, Berlin]

Share:

Daniel Keller: By way of talking about ports, let’s start with your work for the Victoria and Albert Museum, Liquid Citizenship. From your research, which is the most liquid citizenship, which is the most easily attained, and which is the most easily taken away?

Femke Herregraven: Historically, these have been in the Caribbean and part of the United Kingdom’s Commonwealth. Places including Grenada, St. Kitts, Nevis, and Dominica offer instant citizenship, wherein you receive a passport after investing in real estate or paying a certain amount to a government fund. Similar investment programs for entrepreneurs exist in the US, Netherlands, Germany, and many other European countries, as well.

DK: Are there countries that have clamped down on economic citizenship and have become less liquid as a result? I know that the UK is making it harder for foreign billionaires to be domiciled. You must be there 90 days a year, I think. I think that’s also why Roman Abramovich became an Israeli, and there’s others that are leaving the UK. Is there anywhere else that you think has changed since you’ve started doing research?

FH: When I started researching countries with these programs three years ago, in 2015, Hungary had started a new citizenship investment program a few years earlier. More than 80% of people who acquired an instant Hungarian citizenship by investment were Chinese. Recently the program has become much stricter, but it’s still an interesting paradox, given their strong position in the recent refugee crisis.

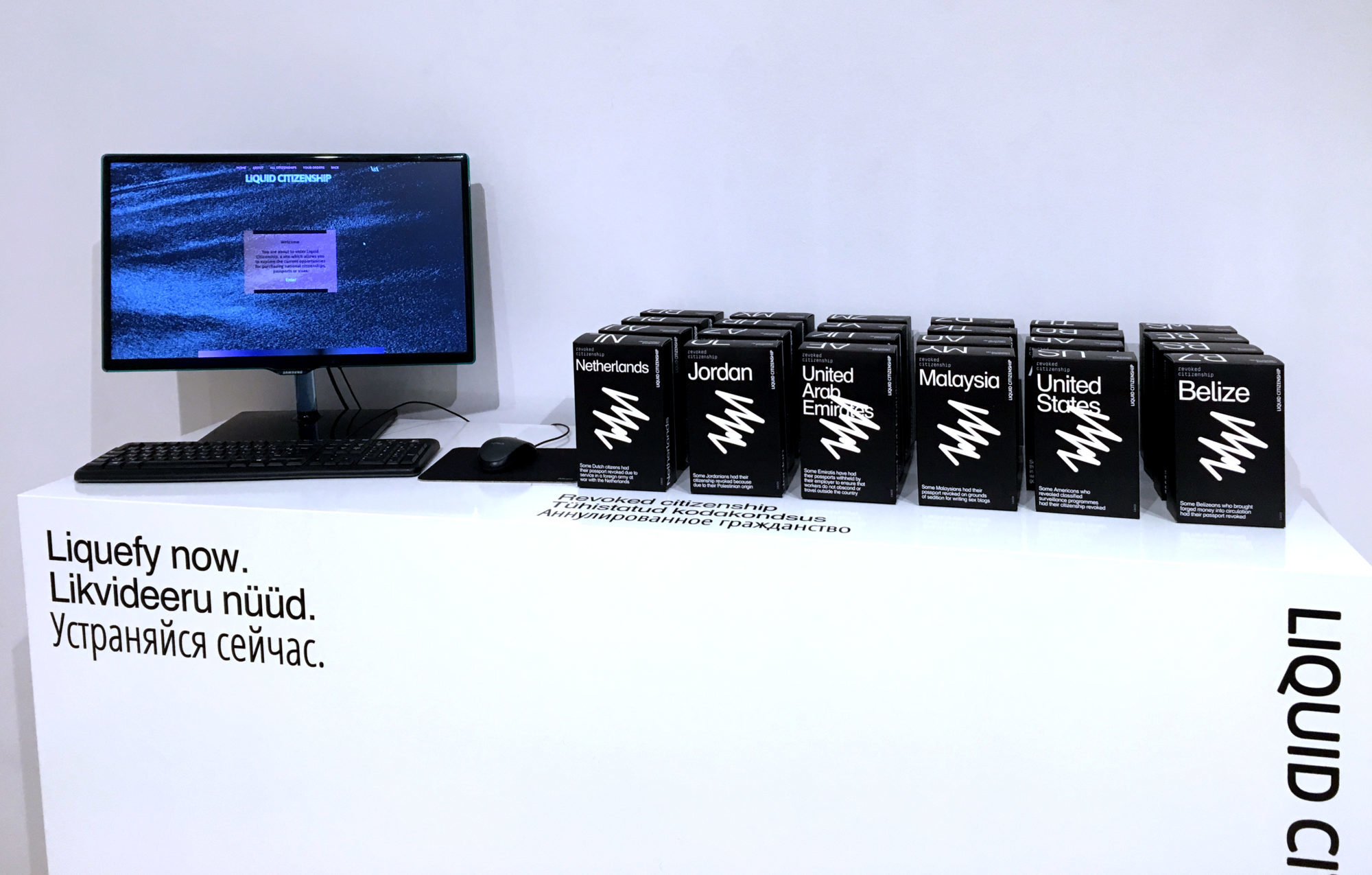

Liquid Citizenship, 2015 – 2018, installation, citizenship packages, badges, lanyards, website, installation view at Art Hall Tallin (EE) [courtesy of the artist]

DK: It’s surprising to me that Hungary would be open at all to giving investors citizenship.

FH: It’s very paradoxical for its current xenophobic right-wing government.

DK: That is interesting, considering it’s the center of the offshore tax network. It basically all leads back to the City of London, which is its own special economic zone—maybe one of the first. How do you think that sovereignty is being commoditized in the same way as citizenship, in the sense that governments are basically putting regulation up for auction? Is there cultural sovereignty without economic sovereignty? Have you heard about Estonia’s plan for e-residency? It’s a government issued digital identity (https://e-resident.gov.ee/become-an-e-resident).

FH: There are a few places that are attempting it. A self-declared micronation between Croatia and Serbia called Liberland is offering it too. From what I understand, no physical residency is required, but it gives certain rights, like the right to own property.

DK: Does it actually, or is it more like live action role playing?

FH: That’s the plan. It’s almost as if the offshore economy brought this mythical figure into being. A kind of “five flag theory” person. A new type of person that is distributed over different territories, caught up in different places, and reaping the benefits of living between several citizenships. It’s like a person exists in the cracks between various sets of regulations, living in loopholes.

DK: I’ve liked the idea of mimicking transnational corporations and seeing if it’s possible to scale down their perks to apply to a person. Unless you have a lot of money to launder or protect, it doesn’t make sense to do a lot of the same things. There are hacks that one can do. You can go to the UK and get free medical care, even if you’re an American. People can save a lot of money by getting plane tickets to go get emergency operations in the UK. You can get free education in certain places.

FH: To make this distributed existence work you probably have to monitor the offshore industry very closely just to keep up with the policy changes and stay current with the viability of loopholes. It would be a very active, constant construction and redefinition of one’s citizenship, almost the opposite of how we experience our citizenship in the global West. We assume it’s a perpetual right. We travel when we need to; we fall back on it.

Liquid Citizenship, 2015 – 2018, installation view, citizenship packages, badges, lanyards, website, installation view at Art Hall Tallin (EE) [courtesy of the artist]

DK: Seasteading has been my wheelhouse for a while. People are trying to commoditize sovereignty through Blue Frontiers, a for-profit spinoff of The Seasteading Institute. They’re creating the technological products that will allow people to create their own autonomous permanent dwelling at sea. When the Seasteading Institute was met with setbacks in building the first seastead off of Tahiti, they basically became a cryptocurrency scam, with a token called Varyon. The idea is that it will be the official currency of all Blue Frontiers seasteads, and the only currency accepted to purchase property with them. Beyond seasteading, I see a trend for decentralized government mechanisms. People have been a little skeptical after the DAO (Decentralized Autonomous Organization) was hacked two years ago, but there are still many autonomous organizations sprouting up. This has an impact on citizenship and sovereignty means. It’s clear that we’re at the precipice of a pretty big shift in these categories.

FH: Seasteading builds on the history of micronations, right?

DK: Yes. Seasteaders are obsessed with the economic success of Singapore and Hong Kong. I’ve asked them if they’ve read anything by Keller Easterling, and none of them have. They’re not aware of any critique of special economic zones and think of them purely as centers of innovation. A lot of these Silicon Valley people have no patience for criticism. They see it as negativity; they critique by creating.

FH: I’m interested in new micronations as design projects and as narrative artifacts; that’s usually all they are. Claims of autonomy and independence are often totally false, since they are economically backed up by larger states in ways reminiscent of historic ties to empires.

DK: In general, “no man is an island.” Autonomy is a myth. If a true seastead would be realized today in the middle of the ocean, 95% of the goods will be imported from some place with a centralized government that would set tariffs, defeating the point of seasteading to avoid taxes in the first place. There are efforts now to test out special economic sea zones, as if putting the word sea in front of something makes it their innovation. It’s impossible to entirely bootstrap sovereignty. Practically, one would need an army for protection, for which heavy infrastructure is needed. I think it’s telling that Blue Frontiers is headquartered in Singapore. Singapore and Hong Kong are heralded as models, and today, they’re not even that innovative. It’s interesting that economically liberal places are politically authoritarian. This was clearly by design.

Daniel Keller & Jacob Hurwitz-Goodman, The Seasteaders (film still), 2017 [courtesy of the artists]

FH: Singapore is a former colony of the British Empire and a tax haven by design. I’ve been working for a long time on how the contemporary scattered geography of offshore finance developed from the spatial organization of the British Empire. Half of the 19th-century British colonies were connected to the City of London in a global spider web of early telegraph lines. Because many Caribbean islands were tightly wired up in the global telecommunication system and yet distant enough to not contaminate the center of the Commonwealth, they became parking places for capital in the 1970s.

DK: Hong Kong, too. I think it’s accurate to call micronations design projects. They seem to be more about building an idea of a country rather than actual governance.

FH: Yes. Taking this further, I’m interested in how finance produces and designs new territory. A physicist from MIT gave a talk on seasteading a few years ago. He believes seasteads can only become viable when used as nodes in financial trading networks. That’s the only sector which has enough capital to push it forward. He and his colleague developed a dataset of mid-location points between stock exchanges, of which many are in oceans. To them, inhabited seasteads seem a nice utopic idea, but in no way realistic. If seasteads would be floating on seas, they would be uninhabited and used for high-frequency trading. Any other function would not be viable.

DK: I’ve heard about that idea. Seasteads would be nodes of new ley lines. It’s not pragmatic to be in the middle of the ocean. It’s really difficult to be there. If all you want is a tax break, many existing islands can serve that purpose. A recent example is the “Cryptopia” phenomenon, where the more despicable of the newly wealthy crypto people are moving to Puerto Rico to avoid paying federal taxes. The word cryptopia hints at utopian promises, but it’s a very cynical economic model. It makes sense for seasteads to become data havens for algorithms. It’s like space exploration. There’s so much to learn, so much data to gather, but it doesn’t make sense to send people out there. Could you tell me about your piece called Durational Monochrome (2017)?

Femke Herregraven and Ana María Gómez López, Durational monochrome, 2017, installation view at Rijksakademie OPEN 2017 [photo: Gert Jan van Rooij; courtesy of the artist]

FH: It’s a collaboration with artist Ana María Gómez López, a fellow resident at the Rijksakademie. It was the first intervention of our collaboration called CRYPTO FILE | CRYPTO LIFE, and it took place the Rijksakademie building, which hosts artists’ studios and workshops. We wanted to point out that there are many other residents as well, and they in fact have been there much longer than the artist community of the Rijksakademie, which was founded in 1870. Over the course of months we cultured these microorganisms in Winogradsky columns as a way to visualize a world that is normally not accessible to our human eye. The reason … we see an emergence of these types of works in the last few years is probably because it’s finally creeping in on us that many nonhuman forms of intelligence are surrounding us. It’s like finding out there is a new kid in your class that’s way smarter than you are. So, what do you do? You probably would want to hang out with them. But how do you hang out with microorganisms? To me it seems we have a paradoxical relationship to life and intelligence. On the one hand we create robots, which are directed to simulate life by its most primitive points—such as movement, behavior, metabolism—while on the other hand there are many existing life forms we don’t acknowledge as being alive. Naming an organism an extremophile says more about our human bias in assessing narrowminded conditions for life, rather than about the “extreme” characteristic of that organism and its ecosystem. Our definition of life is so human centered. We equate it with animation.

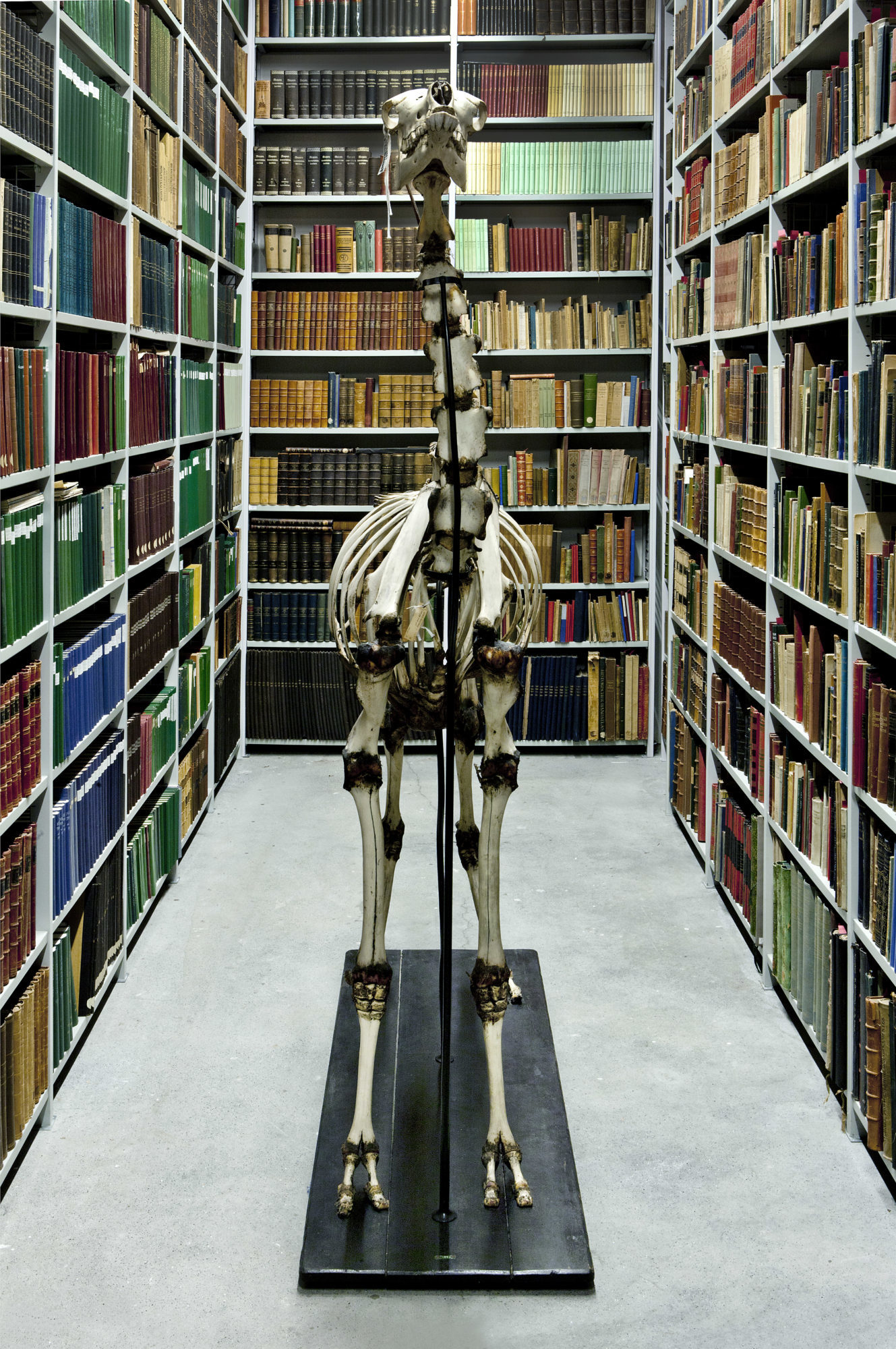

Femke Herregraven and Ana María Gómez López, Durational monochrome, 2017, handmade Winogradsky columns, cyanobacteria, osteological camel specimen, video, prints, installation view at Rijksakademie OPEN 2017 [photo: Gert Jan van Rooij; courtesy of the artist]

DK: Can you tell me more about your project Sprawling Swamps (2016–on-going)? You’ve described it as a metastructure and a virtual reality interactive piece.

FH: It’s an interactive digital environment consisting of a series of scenarios that grows over time, along with my practice. Scenarios develop first digitally and then in physical forms, such as sculptures and installations, or the other way around. The piece hosts the deep entanglements between my different works. What connects the different scenarios is that they are speculative infrastructural projects … distributed on locations that exist with the cracks and corners of the contemporary financial geography. Located on swamps, waves, melting ice, erupting volcanoes, shifting shorelines, and sinking islands, these fictional scenarios explore value production on unstable terrains where the binary presumption of land and water is ineffective. In locations that I research and partly visit, the dynamic nature [of] geological matter itself—and therefore its territory—complicates legal framing and its absorbance into functional infrastructures, whether legal, physical or social. When territories melt, erode, or drown, it becomes unclear what is to be governed. It is from this ambiguous condition that Sprawling Swamps underpins uncertainty, exhaustion, and regression as new forms of value and conditions to be embraced in contemporary life.

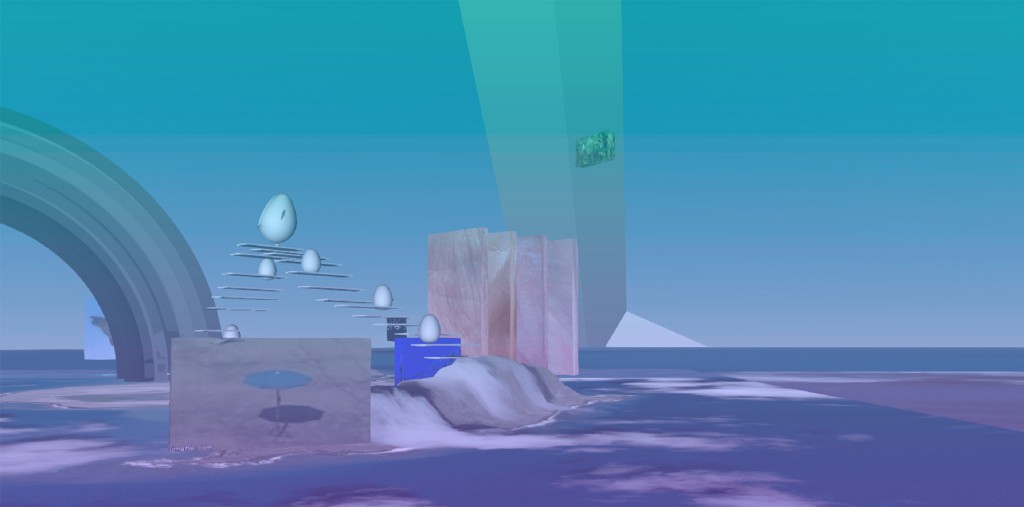

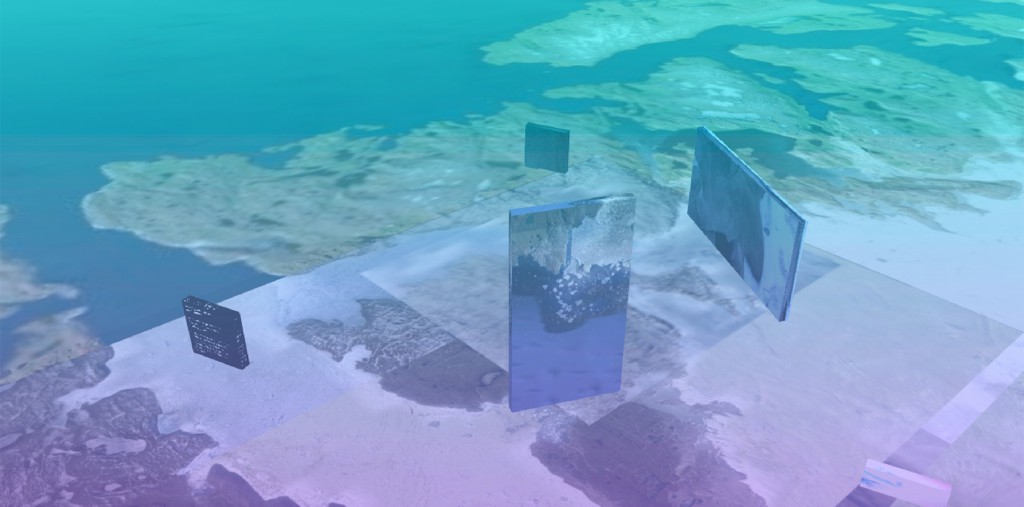

Sprawling Swamps (still), 2016 [courtesy of the artist]

DK: Almost like a next-level portfolio. I’m operating in a similar way. I don’t necessarily want to get closer to the data, but I want to get closer to the content. What are cat bonds?

FH: Catastrophe bonds. I have been working on them a lot in recent years. The first cat bonds were issued in the mid-1990s and became more prevalent in the subsequent years. They represent a strange and special part of an investment portfolio, as they are unrelated to other products, market trends, or political situations. They’re constructed around potential natural disasters and other large-risk events. In a way, they’re insurance for insurers that don’t have enough capital when catastrophes hit.

DK: Do you know how big the market is for those?

FH: I don’t know exactly, but I know that there has been a massive growth. Experts say there is more demand for cat bonds than there is “risk on the ground.” I’ve compiled all cat bonds ever issued since 1996, and it’s basically a collection of fictional disasters which actually never occurred, with the [exception] of the eight bonds that defaulted, but are nevertheless circulating in markets and generating capital as we speak. Some cat bonds ensure a risk named “extreme mortality.” It’s scary when you start to think about what that could even mean. Catastrophe is literally a trigger event to bet on, like a lottery.

Sprawling Swamps (still), 2016 [courtesy of the artist]

DK: Is this material you started looking into when you were making rubber tile objects?

FH: Yes. I’ve been working on this since before I made Malleable Regress (2016). Malleable Regress is work on the materiality of global trading infrastructures. This contemporary infrastructure has its roots in the “All Red Line,” a mid-19th-century network of submarine telegraph cables constructed by the British Empire to connect its colonies to … London. For the insulation of these first-generation submarine cables, a natural rubber from the Malay Peninsula, named percha gutta, was used. Since it was the only type of rubber resistant against salty sea water, it became the holy grail for this new technology—similar to what coltan is to our mobile devices. Rubber plantations emerged subsequently, and during my research I collected several early-20th-century photos from one of the rubber plantations via archives. One photo depicts a young boy next to a stacks of percha gutta tiles, ready to be shipped out. A few years later, I found online messages of beachcombers who had found strange blocks along the coasts of the Netherlands, France, and the UK. The blocks had a strange inscription that actually matched with the inscription on the tiles in the that photograph. It turned out to be the name of a rubber plantation in Java. Tiles were shipped from there to the West, but the ship sank in the early 1900s on its way there. The cargo of the ship had been on the bottom of the ocean before it somehow broke loose and washed ashore. Eventually I was able to trace … three of these blocks, and the sculptures of Malleable Regress are casts from them, including the scratches and traces of their journey.

DK: Do they smell?

FH: Yes, they do, and they still change color—which gives them a timeline. When casting them, I added a tube inside them including a unique coordinate of one of the mid-locations of the new, speculative, high-frequency trading network we spoke about earlier. Malleable Regress addresses … a ghost from the past, the first historical “global” network, and at the same time the new speculative one, that is yet to come.

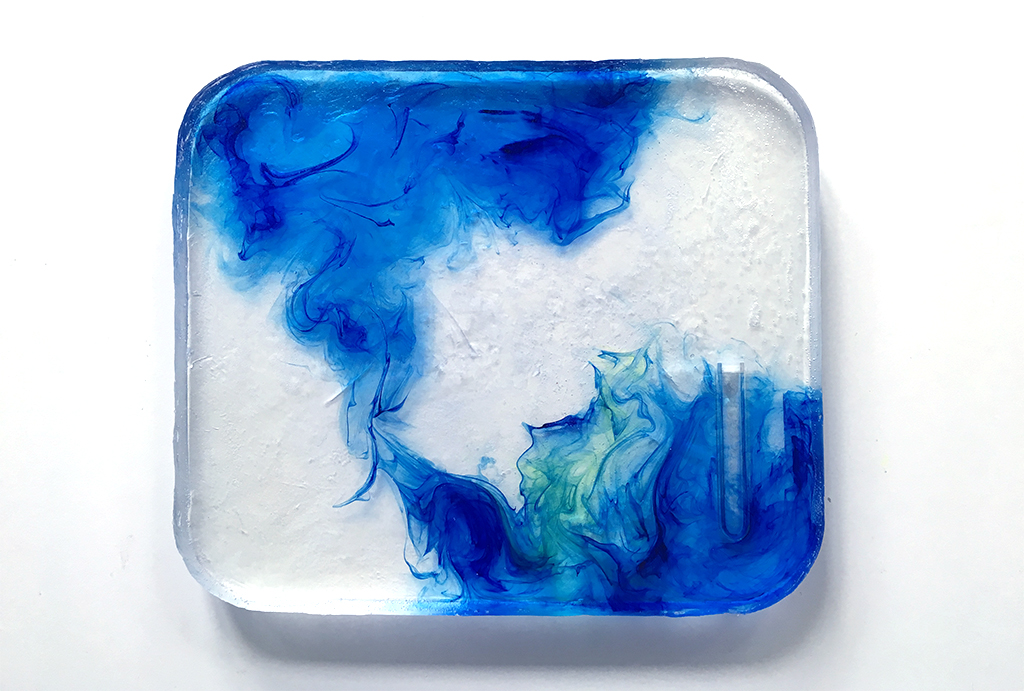

Femke Herregraven, Malleable Regress – Arctic, 2016 [courtesy of the artist and Future Gallery, Berlin]

DK: That’s great material on global trade. I’ve downloaded around 13 white papers of various art start-ups that are either creating an OTC over-the-counter market for exchange or making some kind of tokenization scheme, fractional ownership of artworks, or other ways of further financialization and making more derivatives out of traded artworks. Maecenas, for example, allows you to buy shares in famous works. This type of financialization is definitely not what the art world needs. A lot of these start-ups claim that they are making the market more transparent. That’s a nice idea, but it’s also clear that the only reason the art market functions is precisely because it is not transparent. It doesn’t replicate other financial systems. I’m wondering if this is the inevitable trend, the next step after the global art fair, the free port system. Will people stop going to events and just trade, speculate, and make futures?

FH: I haven’t interacted with any of these start-ups, but I think you’re right. It seems that it’s in art’s nature to become a derivative. It started in the late 60s, early 70s, with market deregulation and value disconnected from gold. The dematerialization of money and the emergence of financial markets, of course, coincided with the idea of the dematerialization of the art object. Finance and art started to function by similar properties. They’re both descriptions of things that aren’t there. They trade on indexical value, on derivatives, and the object itself doesn’t need to “be there” for it to be financialized, as we know from free port art storage. And of course, the least regulated financial market is the art world.

DK: I don’t know why blockchain people want to add an immutable registry of provenance, when the flexibility of the art market is a feature, not a bug. Yes, art and money both dematerialized at some point, but the art object has come back with a vengeance. As far as I know there’s no speculation on conceptual art. I think a lot of people in our generation had hoped that new forms of the art market would appear. I think it’s more conservative than ever. Art’s rematerialization brought with it all the baggage of dematerialization. It’s still just a referential object. Objecthood stopped being important. It’s just easier to comprehend an asset when it has tangible form.

FH: Don’t you think the market today is such that the most radical performances still get sold?

DK: Very few of them, and they are the exception, not the rule. There’s Tino Sehgal, and I don’t know how much money he’s really making. Right now, my ambition is to communicate directly to a much larger audience, or at least a different audience than the art world. At this point, I don’t think there’s much point in trying to disseminate ideas within the art world system. You went from being a designer to being an artist, right?

Femke Herregraven, Malleable Regress – Arctic, 2016, cast polyurethane rubber tiles, pigment, acrylic tubes, bauxite, granite, aluminum, Iceland spar, desert sand, carbon, fiber and magnets, 11.25 x 13 x 1 inches [courtesy of the artist and Future Gallery, Berlin]

FH: My work is spread among a few different fields. Design can reach a very large audience from various backgrounds, but to maintain currency, it seems designers constantly have to jump on the next big thing. At some point I wanted to dig deeper. When you broadcast your thoughts, at some point you need to develop new ones, and design, with its high speed of production, didn’t seem like the best place for me to do that. Art affords space and time to think and develop new ideas, but it’s not necessarily the best venue to distribute them.

DK: I very much agree, but to disseminate ideas in the art world also requires a lot of compromise. If you want to have a sustainable career you need to make a certain size wall hanging or object that assures a profit margin. You can get as wild as you like in your head, but you still need to distill those ideas into a marketable medium. Ideas need a vessel, but for me it became a really frustrating vessel, compared to a text or film or a podcast. The process of making it is really fascinating, but I don’t know. I like my information correct, I guess. For the past five years I have been looking at the sea as a venue for the confluence of trends I’m interested in, like, automation, corporate finance, technology, and ecology. The sea has been an idea matrix for discussing these topics, especially seasteading.

FH: When did you start working on seasteading?

DK: I had been interested in seasteading in a poetic, speculative way for some years, but it was only last year that I reached out to the seasteading community. I spoke at Digital Life Design in 2012, where I met one of Peter Thiel’s chief advisors, who put me in direct contact with the seasteaders. Although I didn’t always voice my criticism of their project, I was always honest with them. They understood what I was doing and allowed me to make a documentary of their activities in Tahiti. They gave very candid interviews and opened up in ways I have not seen them do with journalists. Most articles about seasteading are done in this Vice-style sensationalist way that paints them as these billionaire white dudes form the Bay area who at one point had the support of Peter Thiel. So many writers allow claims to go unquestioned. They are not billionaires but much more average. I made this film in collaboration with someone who makes films. He wasn’t familiar with the subject matter. I provided the access and insight, and he brought his skills in filmmaking and narrative construction. With this documentary, I felt that being able to present something directly was an accomplishment. This is the direction I want to go in: research, direct engagement, and straightforward presentation. It’s also a whole new experience for me. My audience is still the art world, so the reaction to it was much more limited than I would have liked. The New York Times Doc section wants an abridged version, so I hope that will finally give me a nonart audience. I’m curious: you’ve obviously been fascinated by trading and finance for a while, but have you ever tried to do it for yourself?

Daniel Keller, Lazy Ocean Drift (Deutsche Neuaufname), 2014, Audio (4min20sec), Soca Can Speaker, Novelty Flash Drive, USB cables, Power Supply, 4.33 x 2.33 inches [courtesy of the artist and Kraupa-Tuskany Zeidler, Berlin]

FH: No. To me, trading, especially high-frequency trading, is a highly technical and hermetic field. I’m interested the moments it clashes with an aesthetic or infrastructural dimension. Those moments are in a way the breadcrumbs I work with. This sounds lackluster perhaps, but I’ve been working on this for eight years now, without trading myself. This gap allows me to have different speculations on it.

DK: That is so common. It’s a pitfall of being an artist. You make work about something you’re fascinated by, but to make the work, you need the objective distance. I’ve taken a different stance. For me to interact with a topic, I want to get into it. Trading is very technical and abstract, but a lot of it works on a narrative level. Narrative is a clear extension of speculating and having-an-opinion-on-something that takes place in trading. On a practical level, trading has kept me alive for the last couple of years.

FH: What freaks me out about trading is its addictive potential.

DK: Crypto trading is highly addictive because the markets are open 24 hours. You could lose 20% of your worth overnight, and that happens regularly. I have given in very much to that addiction, so I’m glued to my various streams of information. It’s interesting to have a whole generation of people who make ends meet by doing risky derivative trading. This is definitely some sort of capitalist dystopia.

This interview has been edited.

Femke Herregraven, ‘The All Infrared Line’ (still), 2012 – ongoing, cable landing point France [courtesy of Femke Herregraven]

This conversation originally appeared in ART PAPERS “Ports of Call,” Summer 2018.